The following are some samples of my writing. As a strategic communications specialist working in advocacy and persuasion, I have written scripts for video ads which have received hundreds of thousands of views, press releases and media advisories which have resulted in hundreds of thousands of dollars of earned media coverage, Op-Eds which have appeared in major media outlets, and more.

- Blog Post 10

- Branding 2

- Call to Action 13

- Digital Ad 6

- Earned Media 6

- FHL 18

- Fundraising Email 20

- Miami Corruption Tracker 1

- Miami-Dade Dem Party 69

- Newsletter 29

- OFAF 44

- Op-Ed 4

- Press Release 44

- Radio Advertising 1

- Text Message 8

- Touchscreen Interactive 3

- Update 9

- Video Production 12

- website design 1

Rep. Debbie Wasserman Schultz and Housing Advocates Announce Federal Housing Funds for Struggling Homeowners

In 2022, as Communications Director of Floridians for Honest Lending, I helped organize several press conferences with elected officials to publicize available relief funds for homeowners struggling to pay their mortgages from the American Rescue Plan. These press conferences achieved thousands of dollars in earned media.

The Property Insurance Special Session Starts Today - Watch This Video Explainer

This morning, Floridians For Honest Lending released a series of videos with our partners at FAIR, the Federal Association For Insurance Reform, to educate the public about the property insurance crisis and to call for a consumer-focused approach to stabilizing the property insurance market in Florida.

Floridians For Honest Lending Urges Legislature to Take Consumer-Focused Approach to Insurance Reform

I wrote this press release as communications director for Floridians for Honest Lending. It urged a consumer-focused approach to property insurance relief and promoted a series of videos we produced with FAIR. It resulted in an article in Florida Politics entitled: "Consumer advocates push accountability for bad actors, assistance for homeowners ahead of Special Session"

Floridians For Honest Lending Urges Legislature to Take Consumer-Focused Approach to Insurance Reform

Today, as the Florida Legislature is set to meet this week for a special session regarding property insurance, the consumer lending watchdog group Floridians For Honest Lending and the insurance reform group Federal Association For Insurance Reform (FAIR) released an educational video about short-term and long-term solutions to fix Florida’s broken property insurance market. The video is part of a series about the increased risk of foreclosures if the Legislature fails to provide stability to Florida’s property insurance marketplace.

Rep. Goff-Marcil: DeSantis must prioritize federal aid to help homeowners | Commentary

Rep. Joy Goff-Marcil argues in this opinion piece that if DeSantis can figure out how to send out more than $600 million in corporate welfare in a timely manner, then he should be able to figure out how to distribute the same amount in federal aid to real people in this state who actually need help.

Earned Media For Homeowner Assistance Funds Press Conference with Rep. Lois Frankel

In spring 2022, I helped organize a series of press events to publicize relief funds available to Florida homeowners through the American Rescue Plan.

One of these events was a press conference on May 9, 2022, with Congresswoman Lois Frankel and local state leaders and constituents in West Palm Beach. The earned media through local TV coverage was over $79,000 according to Critical Mention.

The Miami-Dade Bar and Floridians for Honest Lending hold seminar for those at risk of losing their homes

MIAMI- Financial institutions tapped the brakes on foreclosures in 2020 and most of 2021, as a federal moratorium gave the millions of homeowners who lost a job due to Covid-19 some financial breathing room. Many took the route of pursuing loan modifications, in a process that was abused by some banks even during the worst of the crisis.

Don't Miss the Foreclosure Avoidance Seminar on April 7

Are you — or someone you know — looking to file a loan modification, but are concerned the bank is taking advantage of you? We’re here to help!

New Funds Available for Struggling Homeowners in Florida

The American Rescue Plan includes funding for homeowners who are struggling to pay their mortgage, their utility bills, their property insurance or other qualifying expenses. The law prioritizes funds for homeowners who have experienced the greatest hardships.

Homeowner Bill of Rights Introduced

Sen. Ileana Garcia and Rep. Juan Fernandez-Barquin held a news conference in the Capitol on Monday to unveil legislation designed to protect Floridians from predatory foreclosure practices.

Elected Leaders and Affected Homeowners to Hold Event in Florida Capitol to Announce New Homeowner Bill of Rights Legislation

On Monday, January 31st, State Senator Ileana Garcia (SD 37) and State Rep. Juan Fernandez-Barquin (HD 119) will hold an event in the Capitol with affected homeowners and fair lending advocates, announcing new legislation designed to protect Floridians from predatory foreclosure practices from lenders and banks.

Breaking news: Florida lawmakers have introduced a bill to protect homeowner rights

This week marked the beginning of the 2022 Florida legislative session, and we wanted to share some very exciting news with you. Two Florida lawmakers have introduced a bill in the House and the Senate to protect homeowners from the worst abuses of the mortgage and servicing industry.

Nearly 300,000 Florida Households Behind on Mortgage Payments

Recent data from the US Census Bureau’s Household Pulse Survey shows that there are more than 6.3 million households in the United States that are not current on their mortgage payments, and nearly 300,000 of those are in the state of Florida.

Rep. Charlie Crist: Floridians are losing their homes while DeSantis sits on federal aid to help them | Column

Floridians who have struggled economically through the pandemic should not be living in fear of losing their homes when the state is sitting on hundreds of millions sent by Congress to help them.

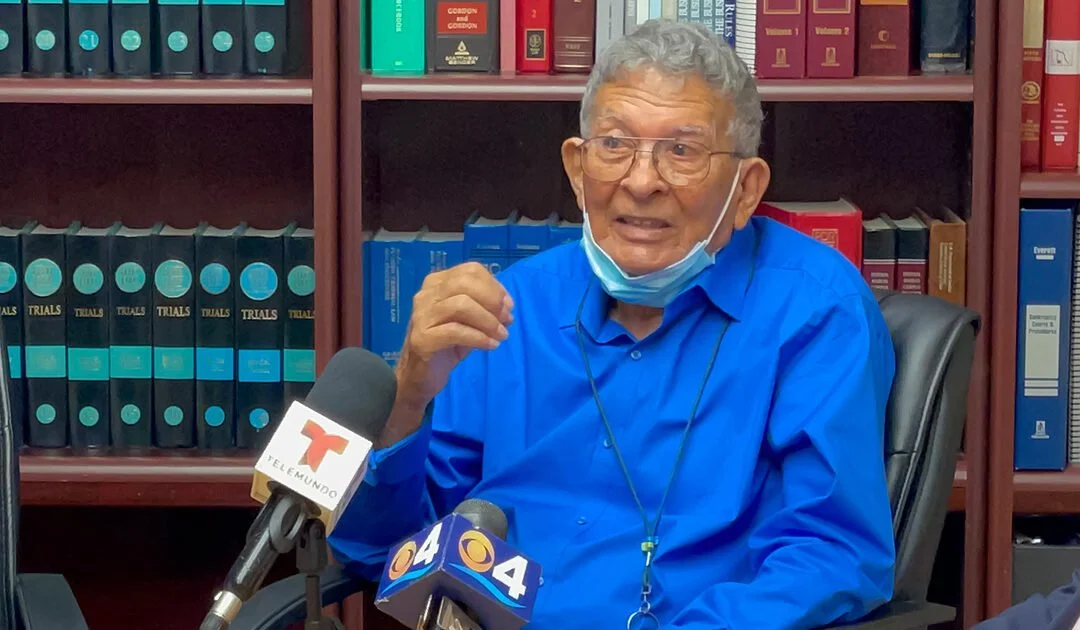

Earned media about the story of José Torrado, a 91-year-old man in danger of losing his home over a $20 accounting error

In 2021, Floridians for Honest Lending held a press conference to publicize the story of José Torrado, a 91-year-old resident of Hialeah Gardens who was in danger of losing his home to a bank foreclosure over a $20 accounting error. Here is some of the earned media coverage of that event. NBC-owned Telemundo 51 (WSCV) and Univision Miami (WLTV) are the first and second rated local TV audiences in the Miami-Fort-Lauderdale DMA.

Ahead of Court Hearing, Floridians For Honest Lending to Highlight Blatant Foreclosure Abuse in Miami-Dade County

Floridians for Honest Lending issued the following press release to call attention to an egregious case of an elderly man facing the prospect of losing his home over a $20 accounting error.

Earned media about the story of Ana Lázara Rodriguez

In the summer of 2021, as the communications director for Floridians for Honest Lending, I helped to organize a number of press conferences outside the home of Ana Lázara Rodriguez. Ms. Rodriguez, who was a former political prisoner held in Fidel Castro’s jails before she fled to the United States in the 1980s, claimed she was the victim of mortgage fraud, and was facing foreclosure as a result. Her attorney Bruce Jacobs asserted that her mortgage papers were fraudulent because they contained illegal “robo-signed” signatures on them.

Video interviews with victims of fraudulent banking practices

I shot and edited several interviews with victims of foreclosure fraud in Florida as part of our work with Floridians for Honest Lending. These stories were included in our push to pass a Florida Homeowner Bill of Rights.